It has not been all rosy in the past week, but the digital asset market has reacted fairly well to the start of Donald Trump’s new administration. Specifically, the Bitcoin price has been able to weather the uncertain storm clouding the cryptocurrency market over the past few days.

While the premier cryptocurrency might have slowed down in recent days, the latest on-chain observation shows that BTC is likely to continue its upward movement. Here’s how the token price might be gearing for another leg up over the coming weeks.

Is There Room For Further BTC Price Growth?

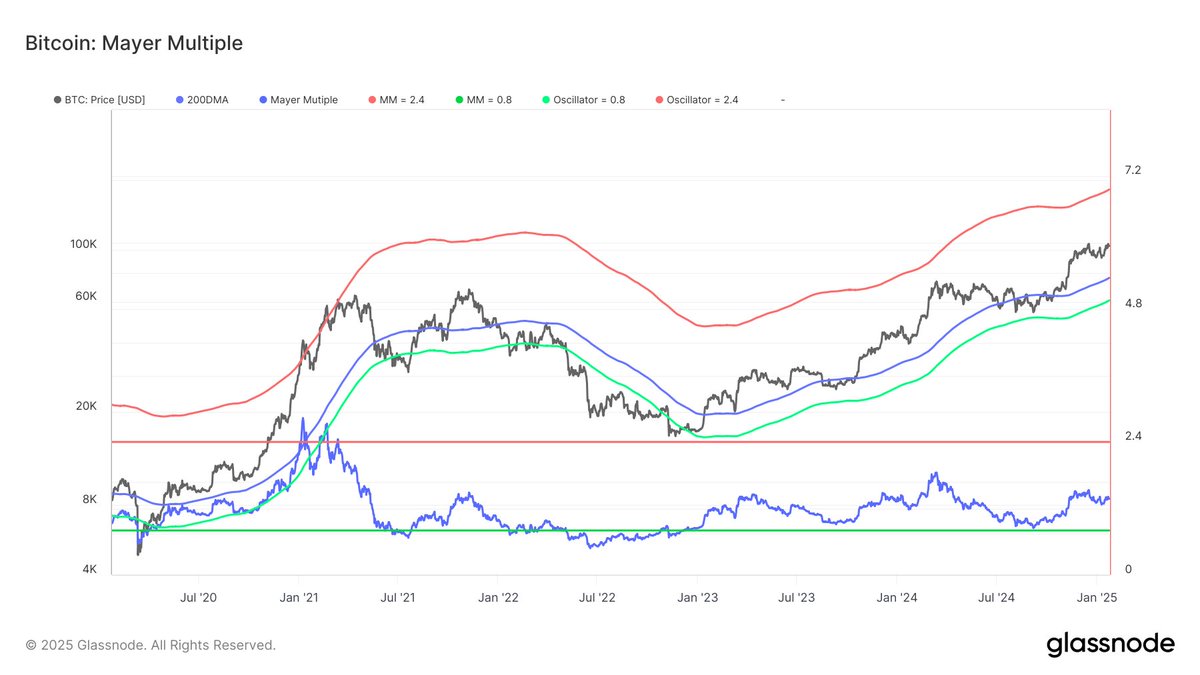

In a Jan. 24 post on the X platform, market intelligence firm Glassnode explained that the Bitcoin price is not yet overheating and still has the potential for further growth over the next few weeks. This on-chain revelation is based on the Mayer Multiple indicator, which is calculated as the ratio between as asset price and the 200-day moving average (200DMA).

The Mayer Multiple measures the distance of the Bitcoin price from its long-term average to estimate overbought and oversold conditions. This metric is also used to establish macro bull or bear bias when analyzing cyclical price movements.

Historically, the Mayer Multiple signals an overbought market condition and a potential price top when its value is above 2.4. On the other hand, a Mayer Multiple value below 0.8 suggests an oversold condition and that a market bottom might be in.

Source: Glassnode

According to data from Glassnode, the value of Bitcoin’s Mayer Multiple stands at 1.37, indicating that the premier cryptocurrency is still quite a distance from the overbought territory. This piece of data implies that BTC still has room for further growth in this cycle. Moreover, the Bitcoin price is at least 35% above the 200-day moving average, which is a bullish signal.

Glassnode highlighted that the price of Bitcoin would need to surge above $180,000 to become overbought. This price level represents the potential peak for the flagship cryptocurrency in this current cycle and could be followed by a trend reversal. With the oversold threshold at 0.8, the Mayer Multiple places the Bitcoin price bottom at around $60,000.

The Bitcoin price has not been particularly impressive since surpassing the $100,000 mark, leading to shouts of a price top in the market. This indicator somewhat provides insight into the potential path of the premier cryptocurrency over the next few months.

Bitcoin Price At A Glance

As of this writing, the price of Bitcoin sits just below $105,000, reflecting no significant movement in the past day.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView